Karobar Card Announcement by Maryam Nawaz

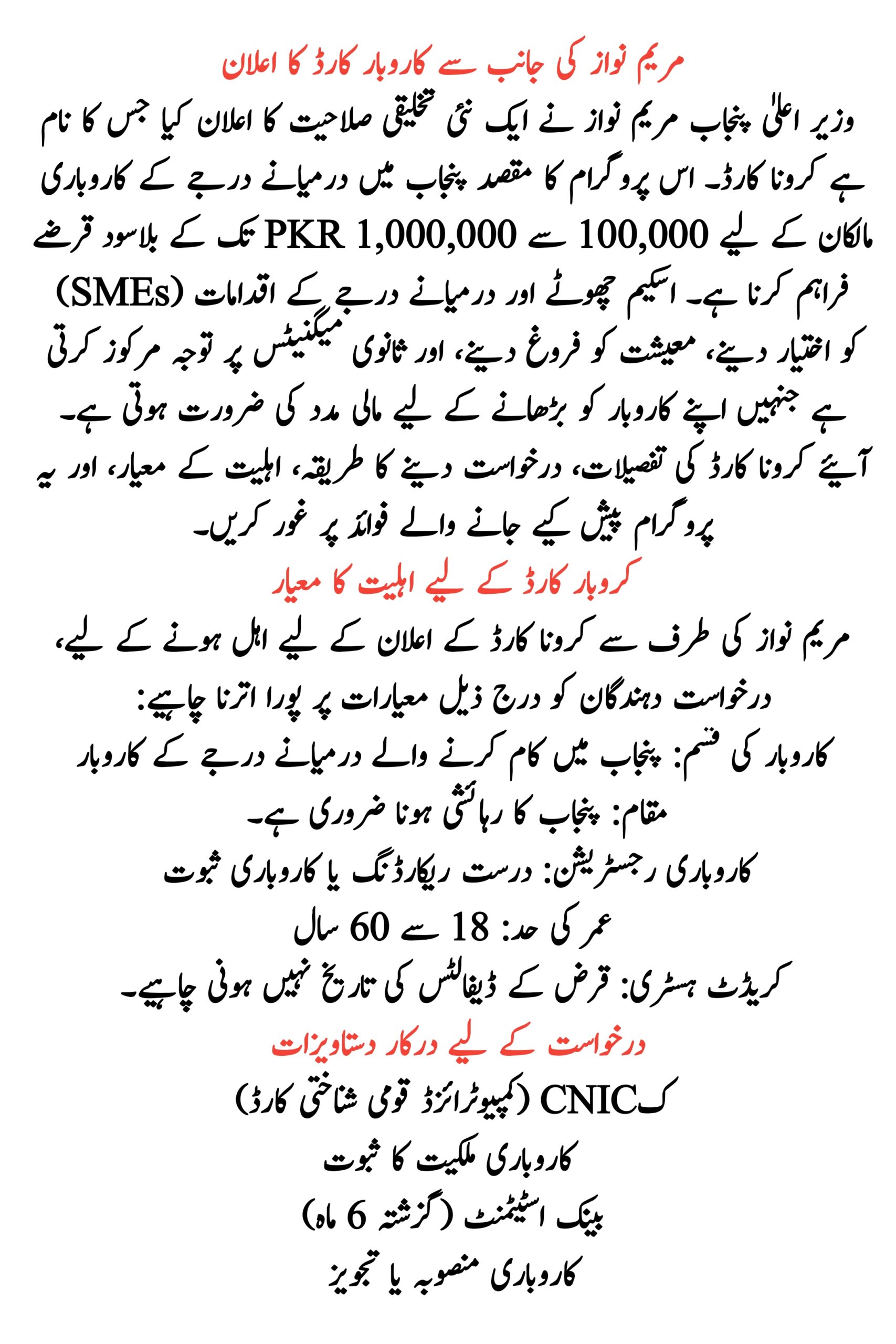

Maryam Nawaz, the Chief Minister of Punjab, newly announced a innovative creativity called the Karobar Card. This program aims to provide interest-free loans ranging from 100,000 to 1,000,000 PKR for mid-sized business owners in Punjab. The scheme focuses on authorizing small and medium initiatives (SMEs), boosting the economy, and secondary magnates who need financial assistance to grow their businesses.

Let’s dive into the details of the Karobar Card, how to apply, eligibility criteria, and the benefits this program offers.

More Read:CM Punjab Free Solar Panel Scheme

Quick Information Table

| Program Name | Karobar Card |

| Announced By | Maryam Nawaz (Chief Minister, Punjab) |

| Loan Amount | 100,000 to 1,000,000 PKR |

| Interest Rate | 0% (Interest-Free) |

| Eligibility | Mid-sized business owners in Punjab |

| Application Method | Online & Offline |

| Assistance Type | Financial loan for business growth |

What is the Karobar Card Scheme?

The Karobar Card Scheme is a financial help program launched by the Punjab government under the leadership of Maryam Nawaz. The primary goal is to provide interest-free loans to mid-sized businesses, ranging from 100,000 PKR to 1,000,000 PKR. This initiative is designed to help tycoons expand their businesses, purchase account, and improve their actions without the burden of interest payments.

Why Was the Karobar Card Introduced?

In Pakistan, especially in Punjab, mid-sized businesses face several challenges, such as:

- Limited access to financing

- High-interest rates on loans

- Lack of government support for SMEs

The Karobar Card Announcement by Maryam Nawaz addresses these issues by offering zero-interest loans to eligible businesses, ensuring they can thrive and donate to the economy. The scheme aims to promote free enterprise, reduce joblessness, and encourage self-reliance.

More Read:Rs 1 Crore Youth Business Loan Scheme

Key Features of the Karobar Card

1. Interest-Free Loans

- Loans ranging from 100,000 PKR to 1,000,000 PKR

- Completely interest-free, making repayments wieldy for businesses

2. Easy Application Process

- Applications can be submitted both online and offline

- A simplified process to ensure convenience for everyone

3. Support for Mid-Sized Businesses

- Specifically designed for mid-sized business owners

- Focuses on business development and financial empowerment

4. Economic Growth and Employment

- Encourages job creation by enabling businesses to grow

- Boosts local economies in Punjab

Eligibility Criteria for the Karobar Card

To qualify for the Karobar Card Announcement by Maryam Nawaz, applicants must meet the following criteria:

- Business Type: Mid-sized businesses working in Punjab

- Location: Must be a resident of Punjab

- Business Registration: Valid recording or business proof

- Age Limit: 18 to 60 years old

- Credit History: Should not have a history of loan defaults

More Read:Govt to Launch Solarization Program

Documents Required for Application

- CNIC (Computerized National Identity Card)

- Proof of Business Ownership

- Bank Statement (Last 6 Months)

- Business Plan or Proposal

How to Apply for the Karobar Card

The application process for the Karobar Card Announcement by Maryam Nawaz is frank and user-friendly. Follow these steps to apply:

Online Application

- Visit the official Punjab Government Website or the SMEDA (Small and Medium Enterprises Development Authority) portal.

- Click on the “Karobar Card Scheme” section.

- Fill out the online application form with your personal and business details.

- Upload the required documents (CNIC, business proof, bank statement, etc.).

- Submit the application and wait for validation.

Offline Application

- Visit your nearest Bank of Punjab branch or government office handling the Karobar Card Scheme.

- Collect the application form and fill it out.

- Attach the required documents.

- Submit the form to the worried officer.

More Read:CM Punjab Free Solar Panel Scheme

Benefits of the Karobar Card for Pakistani Entrepreneurs

The Karobar Card offers many benefits that can help mid-sized business owners grow and succeed:

- Financial Support Without Interest

-

- No burden of interest payments, making it easier to repay the loan.

- Business Expansion

-

- Use the funds to expand operations, buy gear, or increase list.

- Job Creation

-

- Expanding businesses can hire more employees, reducing joblessness.

- Economic Stability

-

- Strengthens the local economy by backup SMEs.

- Simplified Process

-

- Easy application and quick payment of funds.

Frequently Asked Questions (FAQs)

Who can apply for the Karobar Card Announcement by Maryam Nawaz?

Mid-sized business owners residing in Punjab are eligible to apply.

Is the loan really interest-free?

Yes, the loans if under the Karobar Card are entirely interest-free.

More Read:Free Solar Panel Scheme

How much loan amount can I get?

You can get a loan ranging from 100,000 PKR to 1,000,000 PKR.

What documents are required for the application?

You need your CNIC, proof of business ownership, bank statement, and business proposal.

Where can I apply for the Karobar Card?

You can apply online via the Punjab Government Website or offline at Bank of Punjab branches.

Conclusion

The Karobar Card announced by Maryam Nawaz is a significant step toward authorizing mid-sized businesses in Punjab. By if interest-free loans of up to 1,000,000 PKR, this creativity aims to reduce financial burdens and help businesses grow. If you’re a mid-sized business owner, this is a great chance to expand your business and donate to the economy.