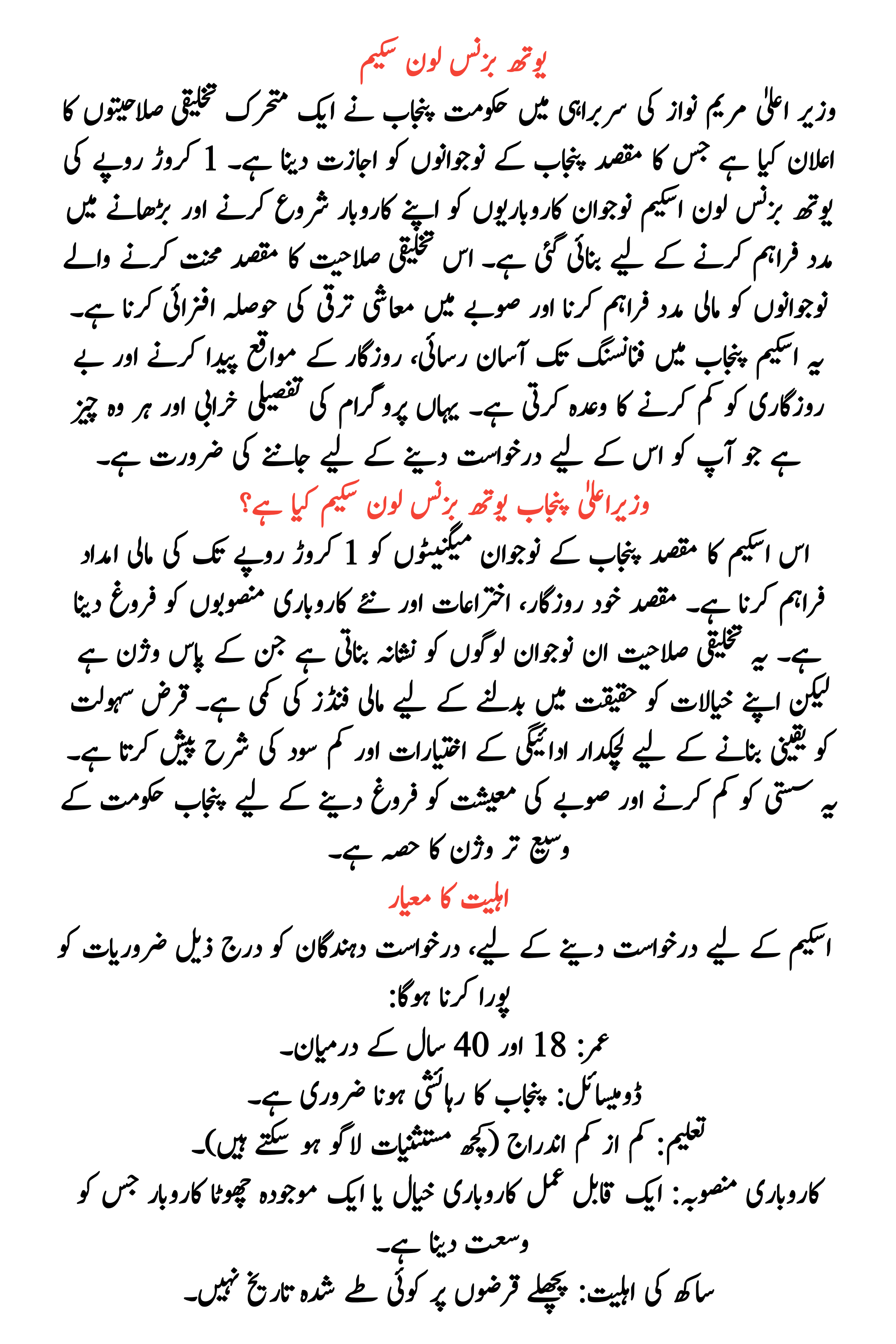

Youth Business Loan Scheme

The Government of Punjab, under the leadership of Chief Minister Maryam Nawaz, has announced an moving creativity aimed at allowing the youth of Punjab. The Rs 1 Crore Youth Business Loan Scheme is designed to support young entrepreneurs in starting and increasing their businesses. This creativity aims to provide financial assistance to striving young persons and encourage economic growth in the province.

The scheme promises easy access to financing, helping job creation and reducing unemployment in Punjab. Here’s a detailed breakdown of the program and everything you need to know to apply for it.

More Read:CM Punjab Free Solar Panel Scheme

Quick Information Table

| Program Name | CM Punjab Youth Business Loan Scheme |

| Loan Amount | Up to Rs 1 Crore |

| Eligibility | Youth of Punjab aged 18-40 years |

| Application Method | Online through official portal |

| Interest Rate | Low or zero-interest options |

| Collateral Requirement | Flexible collateral or no collateral for small loans |

What is the CM Punjab Youth Business Loan Scheme?

This scheme aims to provide financial aid of up to Rs 1 crore to young magnates in Punjab. The goal is to promote self-employment, innovation, and new business ventures. This creativity targets young folks who have the vision but lack the fiscal funds to turn their ideas into reality.

The loan offers flexible repayment options and low-interest rates to ensure convenience. This is part of the broader vision of the Punjab government to reduce idleness and boost the province’s economy.

Objectives of the Scheme

The primary objectives of the CM Youth Business Loan Scheme are:

- Encourage Entrepreneurship: Support young folks in setting up their own businesses.

- Job Creation: Reduce unemployment by creating new job chances.

- Economic Growth: Boost local businesses and rouse the economy.

- Financial Inclusion: Provide accessible financing for youth, with those in remote areas.

- Innovation Support: Promote advanced and supportable business ideas.

More Read:Punjab CM Launches Free Solar Panel Scheme

Eligibility Criteria

To apply for the scheme, applicants need to meet the following requirements:

- Age: Between 18 and 40 years old.

- Domicile: Must be a resident of Punjab.

- Education: Minimum enrollment (some exceptions may apply).

- Business Plan: A feasible business idea or an existing small business looking to expand.

- Creditworthiness: No default history on previous loans.

Key Features of the Scheme

- Loan Amount

- Maximum Loan: Up to Rs 1 Crore.

- Minimum Loan: Amounts as low as Rs 100,000 to cater to small businesses.

- Interest Rate

- Low Interest: The loan scheme offers a minimal interest rate.

- Zero-Interest: In some cases, especially for smaller loans or specific sectors, zero-interest loans may be if.

- Repayment Tenure

- Flexible Terms: Repayment periods can range from 5 to 7 years, depending on the business type and loan amount.

- Grace Period: An initial grace period for payment may be allowed.

- Collateral Requirements

- Collateral-Free Options: Small loans (e.g., up to Rs 500,000) may not require collateral.

- For Larger Loans: Flexible insurance options may be offered.

More Read:Punjab Rozgar Scheme

How to Apply for the Loan

Step-by-Step Application Process

- Visit the Official Portal

Go to the official Punjab government website devoted to the Youth Business Loan Scheme. - Create an Account

Register yourself by providing basic information like your CNIC, email, and contact number. - Fill Out the Application Form

Complete the online application form by entering details about your business plan, required loan amount, and other necessary information. - Upload Documents

Attach necessary documents such as:- CNIC copy

- Domicile certificate

- Business plan

- Educational certificates

- Submit the Form

Review your application and submit it online. - Confirmation and Processing

Once submitted, you’ll receive a validation message. The application will be reviewed, and eligible applicants will be contacted for further steps.

Documents Required

- CNIC: Copy of a valid Electronic National Identity Card.

- Domicile Certificate: Proof of house in Punjab.

- Business Plan: A clear and feasible business proposal.

- Educational Documents: Proof of educational experiences.

- Bank Statement: If applicable, for current businesses.

- Photographs: Recent passport-size photographs.

More Read:BISP Kafaalat Boosts Quarterly Payments for Families

Benefits of the Scheme

- Empowering Youth

This scheme empowers young persons to become job makers rather than job seekers.

- Financial Support

By offering loans up to Rs 1 crore, the scheme addresses the monetary challenges faced by new entrepreneurs.

- Easy Access to Loans

With simplified processes and online applications, applying for the loan is hassle-free.

- Special Incentives for Women

Women entrepreneurs can benefit from additional motivations, making it easier for them to enter the business world.

Frequently Asked Questions (FAQs)

Who can apply for the loan?

Any resident of Punjab aged between 18 and 40 with a viable business plan.

What is the maximum loan amount?

Up to Rs 1 crore.

Is there any interest on the loan?

The scheme offers low or zero-interest loans, depending on the loan amount and business type.

More Read:Punjab Govt Plans Major Metro Bus Expansion to Kasur

How can I apply for the loan?

You can apply online through the official Punjab government portal.

Conclusion

The CM Punjab Youth Business Loan Scheme is a innovative creativity to support young entrepreneurs in Punjab. By providing up to Rs 1 crore in financial help, this program aims to reduce unemployment and foster economic growth. If you’re a young, ambitious separate with a business idea, this is the perfect chance to bring your vision to life.

Stay updated on the official Punjab government website for detailed application guidelines and deadlines