Karobar Card Loan Program

The Karobar Card Loan program is an initiative by the government of Pakistan to support small businesses and budding entrepreneurs by providing easy access to low-interest loans. This scheme aims to encourage entrepreneurship, reduce unemployment, and boost the economy by empowering individuals to start or expand their businesses.

The Karobar Card Loan Scheme is a game-changer for Pakistan’s entrepreneurial ecosystem, offering financial assistance with a streamlined application process. Whether you’re a new entrepreneur or an established business owner, this program is designed to help you achieve your goals.

Read More: Free Solar Panel Registration Online KPK

Quick Information Table

| Details | Information |

| Program Name | Karobar Card Loan Scheme |

| Start Date | January 1, 2025 |

| End Date | December 31, 2025 |

| Loan Amount | PKR 50,000 to PKR 1,000,000 |

| Method of Application | Online via official portal or offline at designated centers |

| Eligibility Criteria | Pakistani citizens aged 21–60 with a valid business plan |

Understanding the Karobar Card Loan Scheme

The Karobar Card Loan program is designed to provide financial support to small business owners and entrepreneurs. The program offers loans at low-interest rates and flexible repayment options to help businesses manage their finances effectively.

The primary goal of this scheme is to:

- Support the growth of small and medium-sized enterprises (SMEs).

- Encourage self-employment and entrepreneurship.

- Provide financial assistance to underprivileged communities.

Read More:1 Day Left in Free Solar Panel Scheme

Eligibility Criteria for the Karobar Card Loan

To apply for the Karobar Card Loan program, applicants must meet the following eligibility requirements:

1. Age Requirements

- The applicant must be between 21 and 60 years old.

2. Citizenship

- Only Pakistani citizens with a valid CNIC are eligible to apply.

3. Business Status

- Both new and existing businesses are eligible for the loan.

4. Income Level

- Preference is given to individuals from low and middle-income groups.

5. Credit History

- Applicants with a reasonable credit score have higher chances of approval.

Click Here For Registration: http://rozgar.psic.punjab.gov.pk/rozgar/register

Creating a Solid Business Plan

A well-prepared business plan is crucial for securing a loan under the Karobar Card Loan program. Lenders use this plan to evaluate the viability and potential success of your business.

Key Elements of a Business Plan

- Executive Summary

- Provide an overview of your business, its goals, and how the loan will be utilized.

- Market Analysis

- Show your understanding of the target market, competition, and industry trends.

- Financial Projections

- Include revenue forecasts, profit margins, and break-even analysis for at least three years.

- Loan Utilization Plan

- Specify how the loan will be spent, such as purchasing equipment or expanding operations.

- Risk Assessment

- Highlight potential risks and strategies to mitigate them.

Read More:BISP 13500 Payment Eligibility 2025

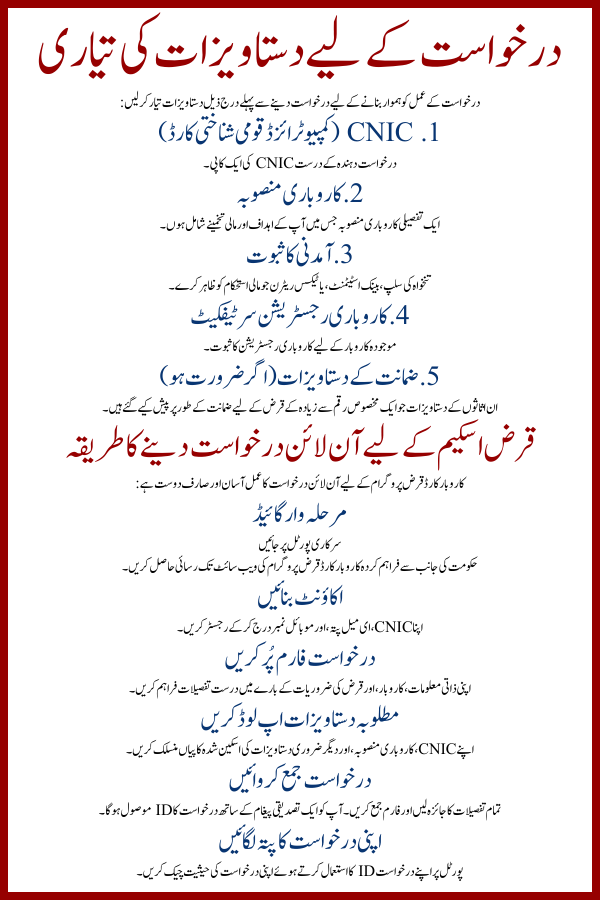

Document Preparation for Application

To ensure a smooth application process, gather the following documents before applying:

- CNIC (Computerized National Identity Card)

- A copy of the applicant’s valid CNIC.

- Business Plan

- A detailed business plan outlining your goals and financial projections.

- Income Proof

- Salary slips, bank statements, or tax returns to demonstrate financial stability.

- Business Registration Certificate

- Proof of business registration for existing businesses.

- Collateral Documents (if required)

- Documents for assets pledged as collateral for loans above a certain amount.

How to Apply Online for the Loan Scheme

The online application process for the Karobar Card Loan program is straightforward and user-friendly:

Step-by-Step Guide

- Visit the Official Portal

- Access the Karobar Card Loan program website provided by the government.

- Create an Account

- Register with your CNIC, email address, and mobile number.

- Fill Out the Application Form

- Provide accurate details about your personal information, business, and loan requirements.

- Upload Required Documents

- Attach scanned copies of your CNIC, business plan, and other necessary documents.

- Submit the Application

- Review all details and submit the form. A confirmation message will be sent with your application ID.

- Track Your Application

- Use the application ID to check your status on the portal.

Read More:CM Solarization Program

Benefits of the Karobar Card Loan Scheme

The Karobar Card Loan Scheme offers several benefits, making it a valuable resource for entrepreneurs:

1. Low-Interest Rates

- Affordable interest rates make it easier for businesses to manage their finances.

2. Flexible Loan Amounts

- Applicants can borrow between PKR 50,000 and PKR 1,000,000, depending on their business needs.

3. Quick Disbursement

- Loans are processed and disbursed quickly, ensuring timely financial support.

4. Collateral-Free Loans (for Small Amounts)

- Loans up to PKR 200,000 do not require collateral, making them accessible to a wider audience.

5. Inclusive Coverage

- Businesses from various industries, including retail, agriculture, and manufacturing, are eligible.

Conclusion

The Karobar Card Loan Scheme 2025 is a visionary initiative aimed at fostering entrepreneurship and economic growth in Pakistan. By providing accessible and affordable financial support, the scheme empowers small business owners to achieve their dreams and contribute to the country’s economy.

Whether you’re starting a new business or expanding an existing one, the Karobar Card Loan Scheme offers a reliable solution to meet your financial needs. Take advantage of this program by preparing a strong application and submitting it through the official portal or designated centers.

Read More: CM Punjab Solar Program for Agricultural Tubewells

FAQs

1. What is the maximum loan amount available under the Karobar Card Loan Scheme?

Applicants can request loans up to PKR 1,000,000, depending on their business requirements.

2. Can I apply for the loan if my business is not registered?

New businesses can apply if they present a comprehensive business plan, but existing businesses must provide a registration certificate.

3. Is collateral required for the loan?

Loans up to PKR 200,000 are collateral-free. Larger amounts may require collateral.

4. How long does it take to process the application?

Loan applications are typically processed within 7–14 business days.

5. Where can I apply for the Karobar Card Loan Scheme?

Applications can be submitted online via the official portal or offline at designated centers and participating banks.

Read More: